How AI and Aerial Imagery Can Improve Crop Damage Assessments in Agricultural Insurance

About Author

Corey Feduck

Director of Business Development at Ceres Imaging

As extreme weather events continue to increase in frequency, insurance firms are partnering with agricultural technology companies to gain efficiency and accuracy in underwriting, fund designation, and claims assessments. By our latest count, at least six of the Approved Insurance Providers (AIPs) in the US have announced strategic partnerships with agricultural technology companies since 2019. As a data-heavy industry, technology adoption in insurance helps with efficient data transfer between customers and insurers, while also reducing risk.

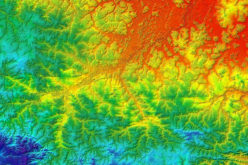

One technological development for agricultural insurance has been the use of remote imaging for crop damage assessments. Geospatial tools such as satellite imagery are increasingly being used to reduce the time providers spend in-field, giving them data on a claim before they even reach the farm in question. Furthermore, there’s an opportunity for AIPs to go beyond satellite technology by combining it with high-resolution aerial imagery coupled with insights powered by AI, bringing improved accuracy and speed to today’s in-person damage assessment methods.

Accuracy

One key benefit that imagery insights can offer insurance providers in managing crop damage assessments is its precision. Accurate representations of planted and impacted acres caused by extreme events make it easier to prioritize and quantify risk. Sharing such data with growers directly also supports a more collaborative relationship, often saving the grower time from having to do the damage assessment manually themselves.

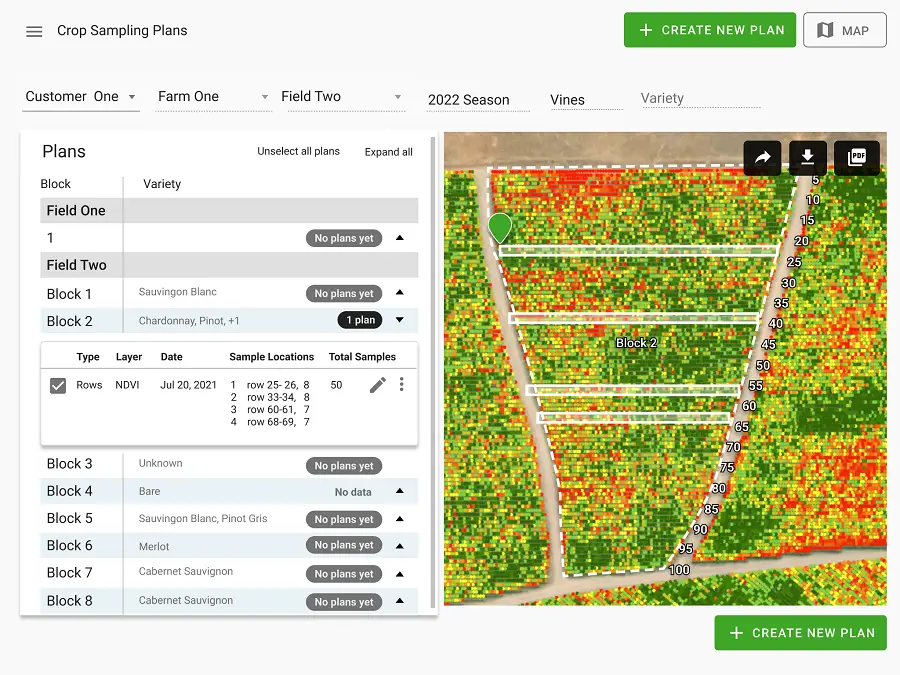

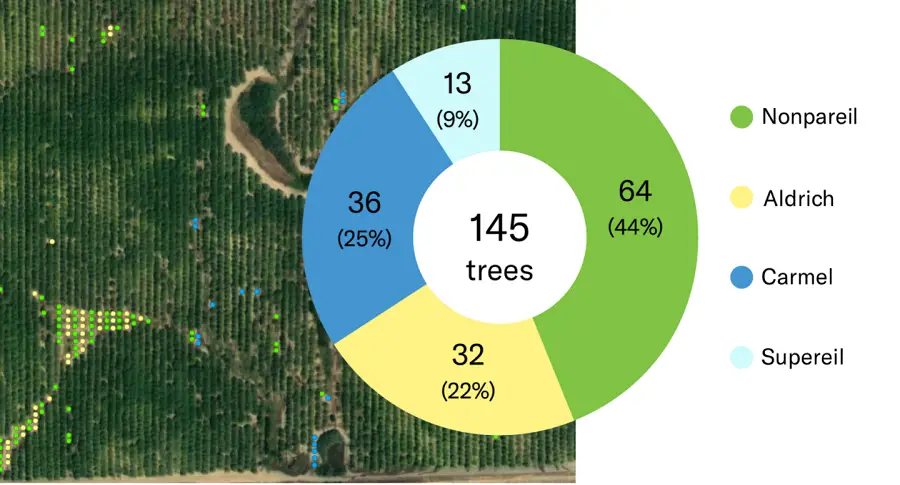

The accuracy of crop damage assessments depends on the technical specifications of the imagery data and the quality of the algorithms used to assess the damage. For example, Ceres Imaging acquires aerial imagery using a proprietary, 5-band multispectral plus RGB camera system at a sub-meter resolution. By combining this high-quality imagery with a neural network based on crop-specific training data, Ceres Imaging is able to separate soil and ground cover from crop canopy. This gives Ceres and its customers the ability to identify and quantify changes to crop health at the plant level, versus the pixelated raster images produced by satellite alone. Having accurate insights associated with the number of individual plants can help assessors improve on standalone in-field observation, by identifying which plants are most affected and thus where in-person assessments are needed, so the scale of the damage is more accurately quantified.

Timeliness

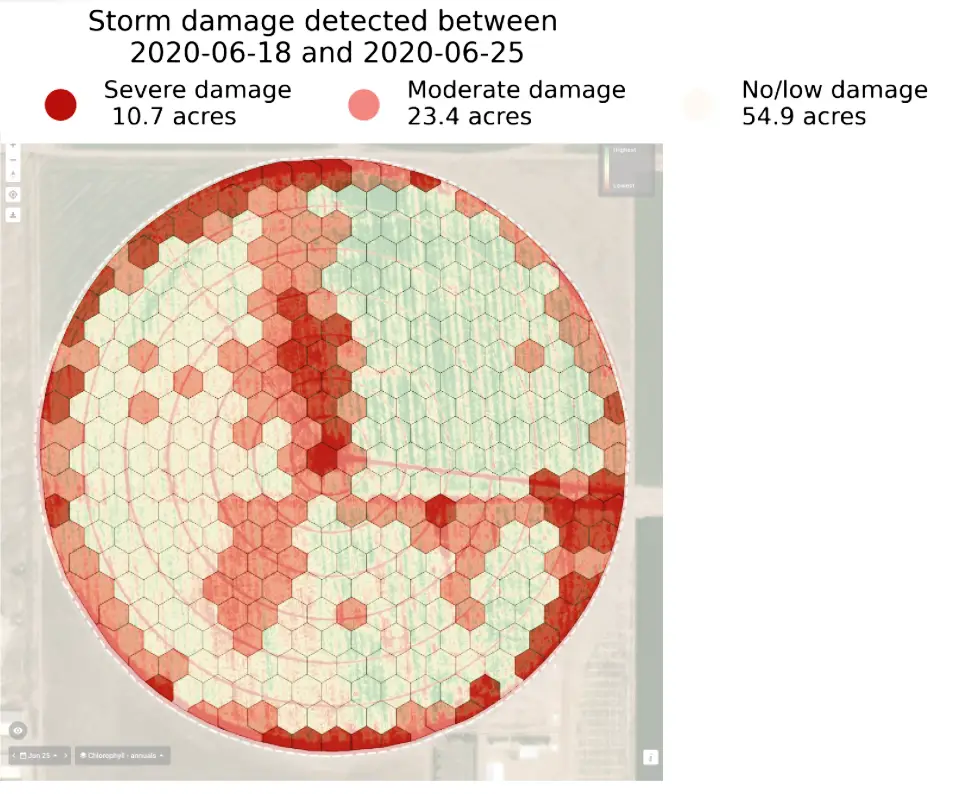

Quantifying damage quickly helps insurance providers reduce cost of assessments and build stronger relationships with their customers. As soon as crop damage has occured, imaging coupled with AI can be used to identify and quantify the damaged crops down to the acre or even the plant level within days of a damage event. Furthermore, certain yield impacts like water stress caused by limited water application can be captured 2-3 weeks before it is visible to the naked eye (and often before the grower themselves know) using advanced thermal imaging from plane based sensors.

Quickly quantifying the exact size and impact of a claim can help field teams manage their time and visits more effectively. For example, after a large-scale hail event, there may be situations where there are more claims than field team members available. Tools like remote imaging become critical to prioritize where field staff should go in these times. Field reps can view their complete portfolio on a mobile-optimized map and filter to view damaged fields according to crop type, length of customer relationship, or size of damage impact. When out in the field, field reps can also use the GPS functionality to navigate to fields to be more efficient with their routes. Choosing the right imaging platform to quickly assess damage events depends on the crop type and the type of event. Satellites are often a good first choice to filter damage assessments because of their relatively low cost. However, satellites alone often cannot provide the immediate turnaround for data that’s needed by insurers after a damage event. Even satellites with a relatively short revisit time can be affected by confounding in-field or weather conditions, such as clouds, that can often lead to wait times of two to three weeks. There’s also an opportunity for providers to use both satellite and aerial imagery in tandem, making in-person visits more effective with quick and accurate data. For example, a sharp change in crop health could be detected by satellite imagery, thus triggering an aerial flight, which can usually be deployed within 24 hours.

Conclusion

By integrating imagery based insights into their operations, insurance companies can increase customer satisfaction and reduce risk with accurate and timely analysis of crop damage assessments. It is unlikely that damage assessments will ever shift to entirely remote solutions like satellite or aerial imagery. Customer service, trust, and relationships are an integral part of the agricultural insurance industry. However, there are ways to improve the efficiency and reliability of these in-person visits – whether through measuring the impact of an event ahead of time, or using data to help prioritize where in-person information is needed. Both insurers and growers could benefit from the deep relationships and on-the ground knowledge that imagery helps facilitate.

Also Read –

Geospatial Technologies for Sustainable Agriculture Development